Can Uber Be Replaced By An Open Source Competitor? (PART 1)

April 28th 2016

As of April 2016, Uber completes 1 million rides a day, across 400 cities and boasts a valuation of over 60 billion USD – staggering for a company that’s barely 7 years old.

Purely as a thought exercise: How difficult would it be for an open sourced competitor to knock uber off it’s perch?

In Part 1, we’re examining the network effects. Is it possible to get everyone to switch over to this new marketplace?

In Part 2, we take a deep dive into the regulatory and compliance requirements of an open source alternative.

In Part 3, we’ll look at the technology challenges. Can the open source community really build an Uber-esque app that works just as well?

In Part 4, we’ll explore some guerrilla marketing tactics taxi app companies have previously used to acquire users. We’ll propose how these same tactics can be used to acquire users for this open source taxi hailing app.

Part 1: The Network Effect

All marketplaces require liquidity – an ample volume of demand and supply.

In the case of Uber:

Demand = Consumers

Supply = Drivers

Highly Defendable Moat? Not quite

While Uber may boast ample liquidity of users & drivers, the cost of either party switching to a competitor are next to nil – literally a press of a button.

Fickle Consumers

Taxi hailing apps are a very different category from other consumer services such as credit cards or email providers.

It’s tremendously daunting for a user to switch over to a new email address. Their inboxes are filled with old messages which occasionally need to be referred to. Similarly for credit cards, most will have thousands of points collected on a particular card. Points which would be lost, in the event of a change in service provider.

These are barriers to consumers. They create lock-ins.

Taxi hailing apps however, are highly transactional. [3] There’s zero cost for switching over. Superior user on boarding UX further reduces the friction of swapping between apps.

Need a new account? Sign in with Facebook connect.

Need to add payment details? Just snap a picture of your credit card.

The low costs for switching has resulted in companies only differentiating themselves by price – resulting in a race to the bottom price war. Consumers though, have repeatedly shown that they’ll respond to these offers, signing up in droves.

Uber or Grabtaxi or Hailo. It really doesn’t matter. It’s just a ride home. There’s no consumer loyalty in the taxi booking world.

Will The Drivers Jump Ship?

Unlike consumers, driver do face some administrative barriers when switching platforms. Mainly related to regulatory compliance matters (license verification etc).

These administrative issues though are likely surmountable (to drivers) given how unhappy they’ve been. Over the past year, we’ve seen driver protests, road blockades, and even class action lawsuits against Uber.

The backlash is understandable. These drivers feel like they’ve been duped. When drivers sign on Uber, they’re promised control over their lives. Have flexible working hours! Earn Loads of cash! Be your own boss!

Unfortunately, you’re not really the boss when you can get kicked off the platform for poor ratings. It’s also not fun when your real boss, Uber, drops prices and raises their commissions – both without any prior notice.

Show me the money!

Here’s a big secret – Drivers will flee to the platform with the best payout.

Mercenary behaviour is highly visible anytime one takes an Uber taxi. Most drivers will have 2, or more, mobile-phones mounted on their dashboards running competing taxi hailing apps.

What keeps drivers on either taxi platform though, are incentives. Between the taxi app companies, it’s lately been a war of who has the deepest pockets.

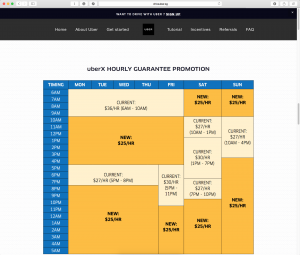

In order to attract and retain drivers on its platforms, taxi apps have been offering a guaranteed hourly wage when certain conditions are met. It’s pretty attractive deal – on paper at least. [1]

The minute any other taxi hailing app offer better incentives, a mass driver exodus follows. It’s repeated itself across multiple cities world wide.

Again, due to the transactional nature and zero switching costs of the marketplace. The next cheaper-better-faster platform is just a click away. Drivers worldwide have shown their loyalty is highly price sensitive.

An open source competitor will be able to attract drivers with it’s low commission structure. However, due the high incentives currently being handed out by dominant taxi hailing companies, such baits would prove insufficient.

Despite the high losses sustained from these incentives, taxi hailing companies have little choice but to compete with aggressive newcomers.

Why Do Investors Continue To Fund Losses?

The strategy of taxi hailing apps is identical to that of the early days of the internet land grab.

Raise lots of money from investors. Grow at any cost. Burn lots of cash by incentivising users and drivers. Squeeze out the competition. Win the market monopoly. Increase prices. Recoup all that money you previously burnt. Repay your investors.

This is often called the “growth over profits” mantra. The above plan rests on 2 key assumptions

1. That you’ll be able to profit handsomely once you’ve secured that monopoly

2. That your investors believe in your ability to secure that monopoly

Paypal, Facebook and Google (to name a few), successfully played, and won, with this strategy. They sacrificed profits for years, concentrating purely on attracting and retaining users.

Uber-Crazy Commissions Will Hinder Growth

Investor appetite for losses won’t continue forever. Eventually, Uber and it’s peers, will have to start charging full, unsubsidised rates.

As of Apr 2016, Uber levies a 25% commission charge on each one of it’s rides in North America.

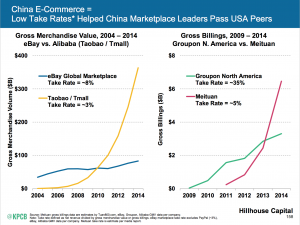

What’s interesting though is that recent research has shown that platforms which take a lower commission, end up doing better in the long run. Here’s a slide from Mary Meeker’s Internet Trends 2015

By charging a more “reasonable” commission, Taobao & Meituan were able to better retain and grow their respective marketplaces – far surpassing their better funded american peers. This is even more impressive when you recognise that they were second movers.

Uber currently charge 0% commission on UberX in China – the same as market leader Didi Kuadi. They do however take a commission on premium vehicle bookings (UberBlack).

In India, Uber retain a 20% commission structure, identical to the market leader, Ola Cabs. It’s a similar structure in South East Asia, with commissions matching the dominant player in each city.

Showdown At High Noon

Because investors believe in the business model, taxi hailing apps will continue to have access to large amounts of capital, which in turn will continue to fund their loss-making incentive schemes, keeping potential competitors at bay.

Rational, highly intelligent, well educated investors have playing a game chicken with each other. Each party is competing to win that monopoly position. Placing increasingly large stakes in competing companies. It’s a western style high noon showdown.

This won’t last forever. Somebody will flinch. It’ll start small, with one investor pulling out. Slowly, the pessimism will spread. This bubble will pop. Funding will dry up.

We’re already seeing this confidence loss happen with other on-demand-economy apps. Sarah Lacy did excellent take on the situation.

Please Don’t Stop The Music

As long as these incentives remain, an open source alternative cannot exist. And it doesn’t need to. Incentives actually benefit everyone. Drivers get paid more. Consumers get cheap discounted rides. It’s a win-win….for now.

When (not if) incentives eventually end, the market will see another round of reshuffling and land grabing. There aren’t sufficient strong network effects to protect uber. High commission structures will squeeze already unhappy drivers. Consumers, who’ve long grown accustomed to artificially cheap rides will baulk at paying full rates.

I’m betting this will create a ripe entry point for an open source competitor.

In Part 2, we dive into the regulatory requirements necessary to operate a Taxi Hailing Application.

[1] While these figures may look promising, they’re highly deceptive and do not take into account the high running costs associated with a taxi car. Here’s some inside commentary from a Singapore-based uber driver’s blog

[2] This is one of the things I love most about the internet. It’s a true democracy.

[3] Ironically, this transactional nature of hailing taxis is what helped taxi apps gain consumer market share so quickly.